Understanding Order Of Utilization Of ITC Under New Rules Of GST

Understanding Order Of Utilization Of ITC Under New Rules Of GST

Understanding Order Of Utilization Of ITC Under New Rules Of GST

Understanding Order Of Utilization Of ITC Under New Rules Of GST

GST framework allows businesses to offset the GST ITC against the output tax liability. The utilization of ITC is governed by specific rules outlined in the GST Act. Over time, there have been amendments and updates to these rules, and it’s essential for taxpayers to stay informed about the latest changes to ensure compliance. Clarity on ITC set-off sequence as per GST Rule 88A clarified in Circular No. 98/17/2019-GST dated 23.04.2019.

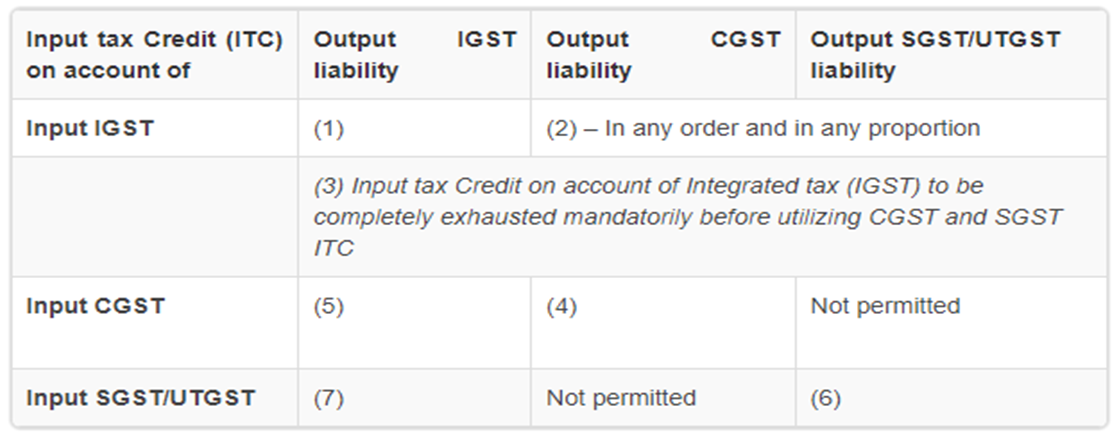

- Summary chart of Order of Utilization of ITC under GST:

After insertion of Rule 88A, the order of utilization of input tax credit (ITC) will be as per the numeric order given below:

- Relevant Provisions:

- Rule 88A of CGST Rules, 2017:

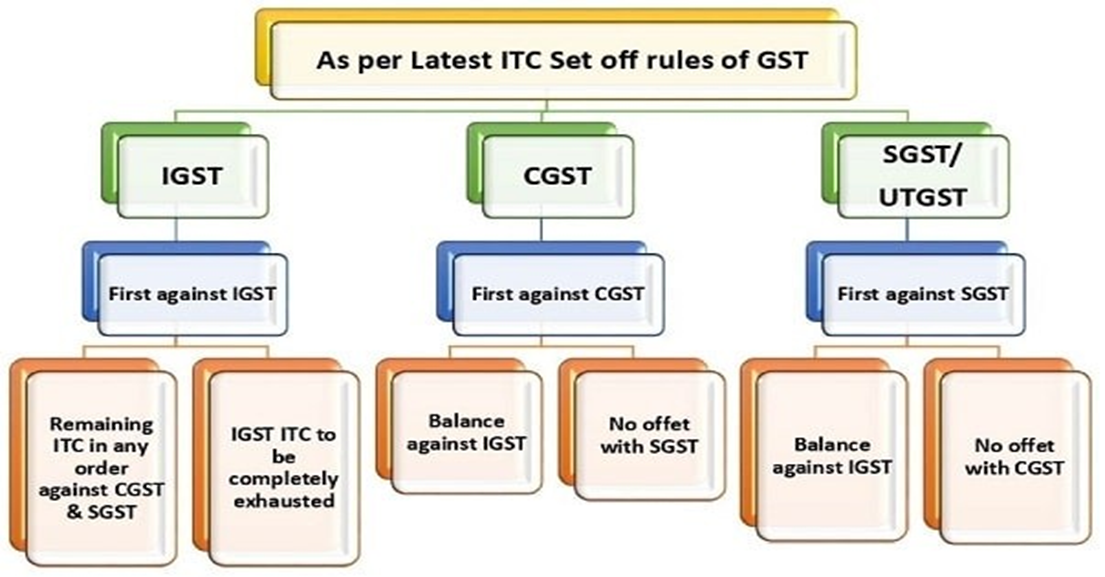

Rule 88A was inserted in the CGST Rules, 2017 vide Notification No. 16/2019- Central Tax, dated 29th March, 2019. The amended provisions came into effect from 1st April 2019. The Board clarified that:

- ITC on account of IGST shall first be utilised towards payment of IGST, and the amount remaining, if any, may be utilised towards the payment of CGST and SGST or UTGST, as the case may be, in any order.

- Provided that the ITC on account of CGST, SGST or UTGST shall be utilized towards payment of IGST, CGST, SGST or UTGST, as the case may be, only after the ITC available on account of IGST has first been utilized fully.

- Section 49A and Section 49B :

Section 49 was amended and Section 49A and Section 49B were inserted vide CGST (Amendment) Act, 2018. The amended provisions came into effect from 1st February 2019.

As per Sec 49A, ITC on account of CGST, SGST or UTGST shall be utilized towards payment of IGST, CGST, SGST or UTGST, as the case may be, only after the ITC available on account of IGST has first been utilized fully towards such payment.

As per Sec 49B the Government may, on the recommendations of the Council, prescribe the order and manner of utilization of the ITC on account of IGST, CGST, SGST or UTGST, as the case may be, towards payment of any such tax.

- Illustration:

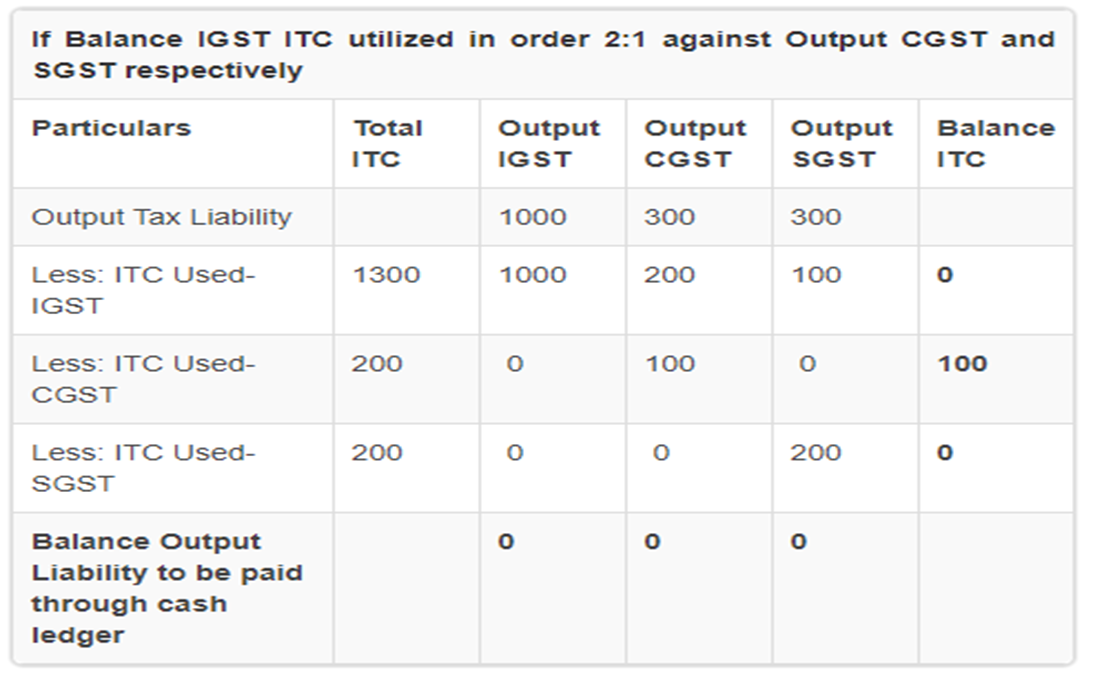

The following illustration given in circular would further amplify the impact of newly inserted rule 88A of the CGST Rules related to off-set of ITC:

Amount of Input Tax Credit available and output liability under different tax heads:

Head | Output Liability |

| |

Integrated tax | 1000 | 1300 | |

Central tax | 300 | 200 | |

State tax / Union Territory tax | 300 | 200 | |

Total | 1600 | 1700 |

Please note that the following options are for understanding purpose only, you may choose any one option and you may change proportion of Input IGST utilization against CGST and SGST liability in any order to optimize utilization of ITC in such a way that minimum cash liability arrives after Set-off.

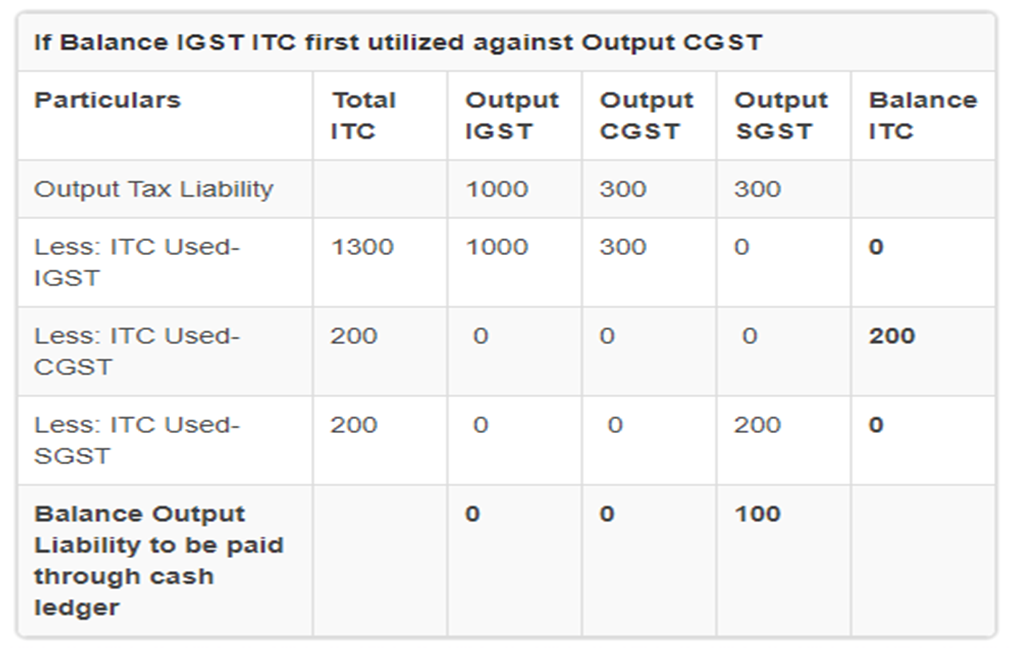

- Option 1 : GST Portal Default offset functionality

Remarks: Option 1 is not beneficial as we cannot utilize ITC of CGST against SGST, Due to this cash liability payable of Rs. 100 under SGST and unutilized ITC of Rs. 200 under CGST head.

Note: Input tax Credit on account of Integrated tax has been completely exhausted before utilizing CGST and SGST ITC. Practical aspect of GST Portal: The GST portal’s GSTR-3B Default offset functionality utilize ITC as per above mentioned sequence i.e on the basis of Option 1. But we can manually modify the ITC offset figures in order to optimize ITC utilization as described below in Option 2.

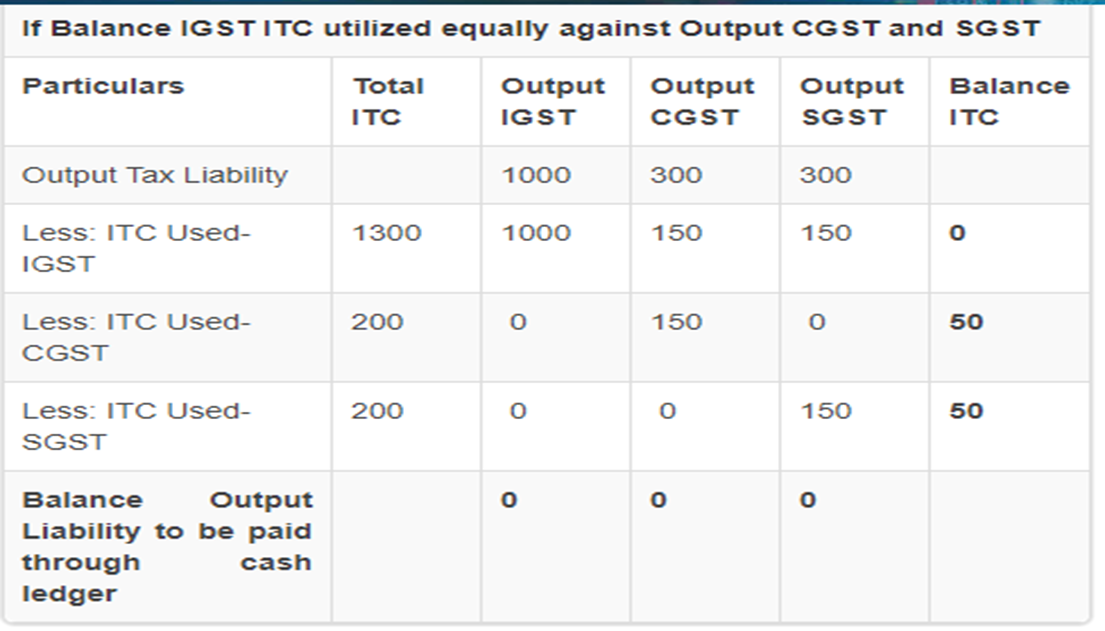

Remarks : Option 2 is beneficial to taxpayers than Option 1 as we have Utilized IGST ITC against CGST and SGST equally, cash liability is Nil and unutilized ITC is Rs. 50 under CGST and Rs. 50 under SGST.

Note : Input tax Credit on account of Integrated tax has been completely exhausted before utilizing CGST and SGST ITC. Practical aspect of GST Portal: The GST portal’s GSTR-3B offset functionality offset ITC on the basis of Option 1. But we can manually modify the offset figures in order to optimize ITC utilization as described above in Option 2.

- Option 3 : Utilized in any order as per taxpayer’s choice

Remarks: Option 3 is not suggested as cash liability is Nil but unutilized ITC is Rs. 100 under CGST and we cannot offset CGST ITC against SGST ITC.

Note: Input tax Credit on account of Integrated tax has been completely exhausted before utilizing CGST and SGST ITC.

Conclusion:

In above illustration, we can conclude that Option 2 is better out of all 3 options. So, according to author taxpayers should identify beneficial order of ITC utilization in their specific case as per above specified rules in order to optimize ITC utilization in such a way that minimum cash liability arrives after ITC off-set.

The systematic utilization of Input Tax Credit is integral to GST compliance. By adhering to the sections and rules outlined in the GST Act, businesses can optimize their tax liabilities while ensuring transparency and accuracy in the credit mechanism. Regular updates and adherence to the prescribed timelines for ITC utilization contribute to a seamless and efficient GST process.

DISCLAIMER:-

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any query or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact at 9633181898 or via WhatsApp at 9633181898.

Featured Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

Latest Posts

- Restoration of GST Registration Allowed Subject to Filing of Returns and Payment of Dues -Jammu & Kashmir High Court

- റിട്ടേണുകൾ സമർപ്പിക്കുകയും കുടിശ്ശികകൾ അടയ്ക്കുകയും ചെയ്യുന്നുവെന്ന നിബന്ധനയ്ക്ക് വിധേയമായി ജിഎസ്ടി രജിസ്ട്രേഷൻ പുനഃസ്ഥാപിക്കാൻ ജമ്മു & കാശ്മീർ ഹൈക്കോടതി അനുമതി നൽകി.

- Allahabad High Court Quashes GST Demand Over Procedural Lapses: Wrong GSTIN, Demand Beyond SCN & Improper Service.

- തെറ്റായ GSTIN, അറിയിക്കാത്ത അധിക ഡിമാൻഡ്, നോട്ടീസ് ലഭിക്കാത്തത് – ഗുരുതര പിഴവുകൾ ചൂണ്ടിക്കാട്ടി GST ഉത്തരവ് അലഹാബാദ് ഹൈക്കോടതി റദ്ദാക്കി.

- No More Silent Auditor Changes — ICAI Releases Updated UDIN Portal Manual with Strong New Mandates.

Popular Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

BRQ GLOB TECH

BRQ GLOB TECH